Desk Report

Publish: 12 Jun 2020, 12:35 pm

Economists claim that the execution of the 'loan dependent' budget for the 2020-21 fiscal year will be a big obstacle for the country, as revenue collection has diminished amid coronavirus pandemic.

They also said that the government's ambitious target of 8.2% of GDP growth for the next fiscal year will not be achieved in the current situation as the world grapples with the outbreak of COVID-19.

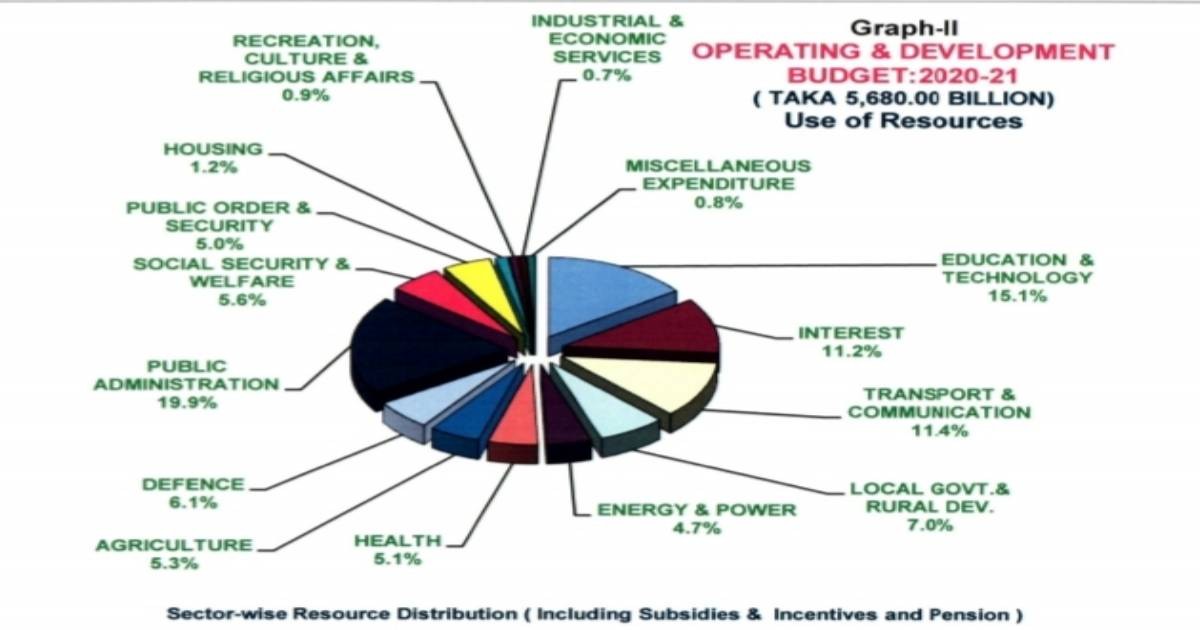

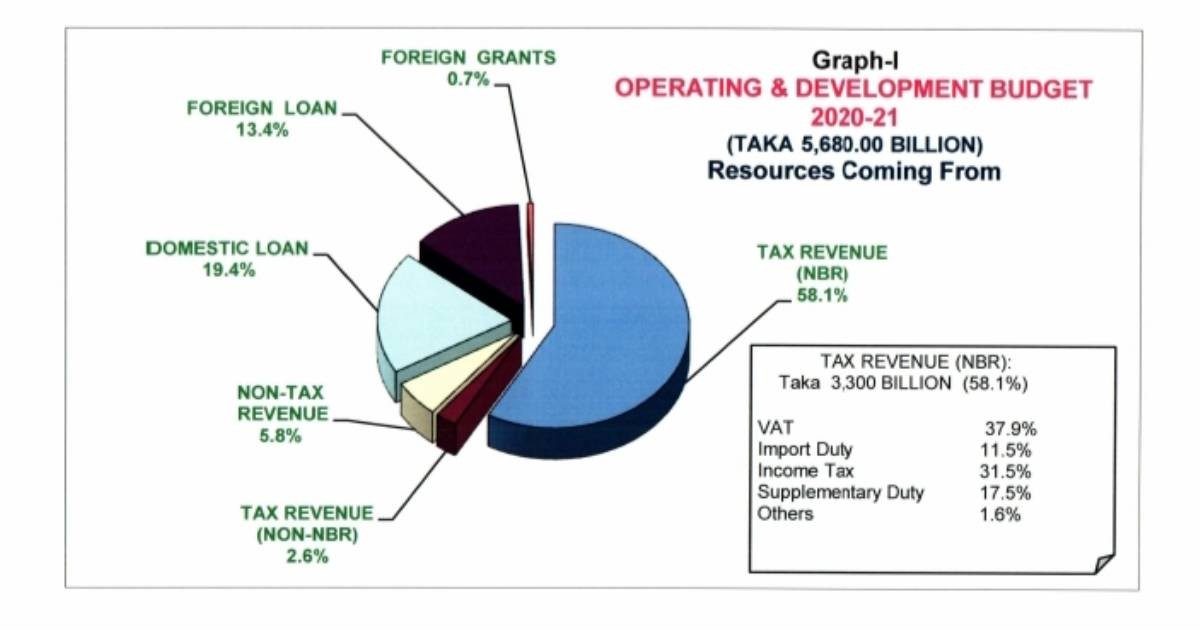

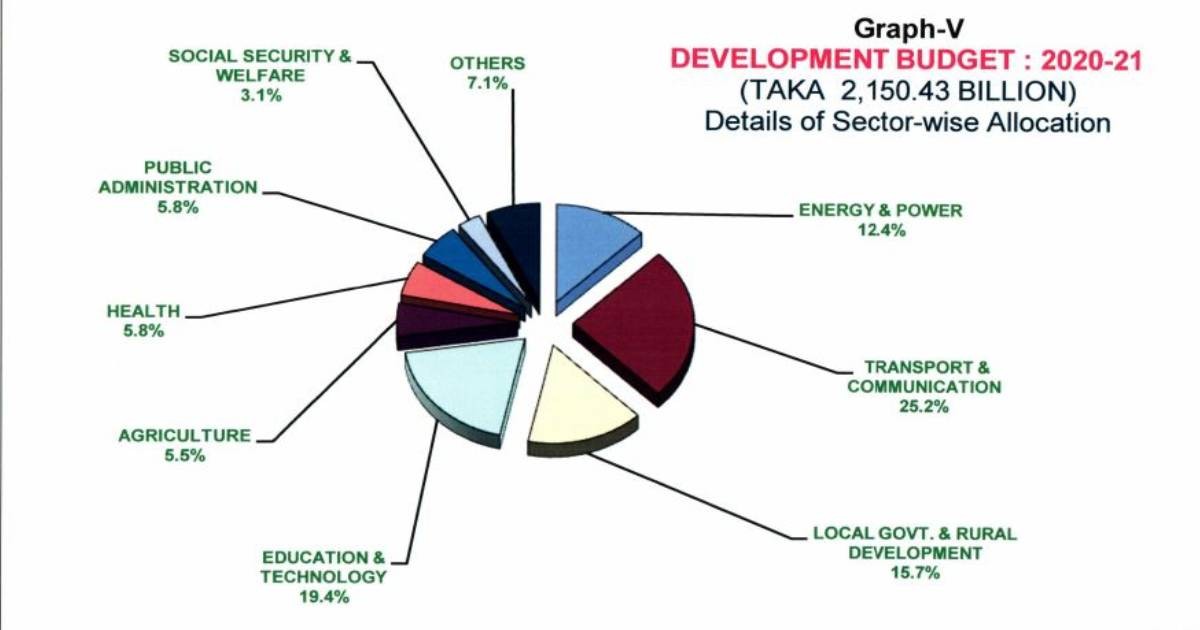

Finance Minister AHM Mustafa Kamal presented the proposed budget of Tk 568,000 Crore to Parliament on Thursday. The revenue collection target has been set at Tk378,000 crore. Of the amount, NBR has been tasked with realizing the revenue collection target of Tk330,000 crore, the non-NBR revenue collection target is Tk15,000 crore, while the non-tax revenue collection target is Tk33,000 crore.

Talking to the media, Dr. Ahsan H Mansur, Executive Director of the Policy Research Institute of Bangladesh (PRI), a private think tank, said the implementation of the budget is a major challenge for the government.

“It’ll be very difficult to implement the new proposed budget in the situation. Where are the resources to collect revenue? The target revenue won’t be achieved this year as NBR managed to collect around Tk215,000 in the last year. How will it meet the target this year amid the pandemic?” he asked.

Dr. Mansur also said there are some positive things in the proposed budget – the government focused on health, the social safety net, and agriculture. "However, progress will rely on research at the field level," said the economist.

He said the government is perplexed amid the COVID-19 situation. “One time, the government said they are at risk in the situation. Again, the government said they will create more employment,” he added.

Skepticism about growth target

Executive Director of South Asian Network on Economic Modelling (Sanem) Dr. Selim Raihan said the goal of this year’s budget should be to tackle the unprecedented health and economic challenges posed by the pandemic and restoration of economic stability.

“Targeting an 8.2 percent growth raises the question whether it has been assumed that economic activities will return to normal shortly and economic growth will resume its previous trend? This assumption means, economic activities will quickly pick up the normal pace and the economy will experience a “V-shaped recovery”. However, the question remains whether reality corroborates this assumption.”

“Targeting an 8.2 percent growth raises the question whether it has been assumed that economic activities will return to normal shortly and economic growth will resume its previous trend? This assumption means, economic activities will quickly pick up the normal pace and the economy will experience a “V-shaped recovery”. However, the question remains whether reality corroborates this assumption.”

“We are witnessing increasing health hazards, rising cases of infection, and deaths. When will it be possible to resume full-fledged economic activities is a big question,” he added.

Dr. Raihan said they are expecting shock to two main drivers of the economy — export and remittance. “The two biggest destinations of our exports — the European Union and North America — are predicted to experience negative growth. Thus, whether in the future, export to these countries will increase and to what extent is a question,” he said.

He welcomed the government’s stimulus packages announced at the beginning of the crisis. However, the stimulus packages will be operated through the banking sector which is in crisis. There are crises of mismanagement, institutional weakness, and default loan in the banking sector, the economist said.

He added that the budget should have had a guideline for the operation of the stimulus packages through such a crisis-ridden banking sector. “I believe, there should have been a guideline for ministries, Bangladesh Bank, and other banks as well in this regard. We are also hearing about various difficulties the SMEs are facing in accessing their stimulus package through the banks,” he added.

“However, I think we can borrow loans from international organizations and in that case, we can negotiate for loans with flexible conditions and low-interest rates. Also, I think Bangladesh does not have much time in this regard as many other countries have entered into negotiations with these international organizations and are negotiating for loans with flexible conditions and low-interest rates,” he added.

Dr Mohammad Mahfuz Kabir, research director at Bangladesh Institute of International and Strategic Studies (BIISS), said the overall budget deficit will be Tk 190,000 crore in the next fiscal year, which is 6 percent of the GDP.

“I think the deficit is not bad for the implementation of megaprojects and creating employment. Many Bangladeshi migrant workers who returned home can’t go back to their country of employment. So, the government must consider creating more jobs as a lot of people lost work during the lockdown,” he added.

Dr. Mahfuz said the government should think about how to attract foreign investment. More investments have to go up to tackle the economic impact. “I think, a supplementary budget might be needed to implement the new budget,” the economist said.

Source: UNB

Subscribe Shampratik Deshkal Youtube Channel

© 2024 Shampratik Deshkal All Rights Reserved. Design & Developed By Root Soft Bangladesh