Desk Report

Publish: 05 Jun 2021, 08:49 pm

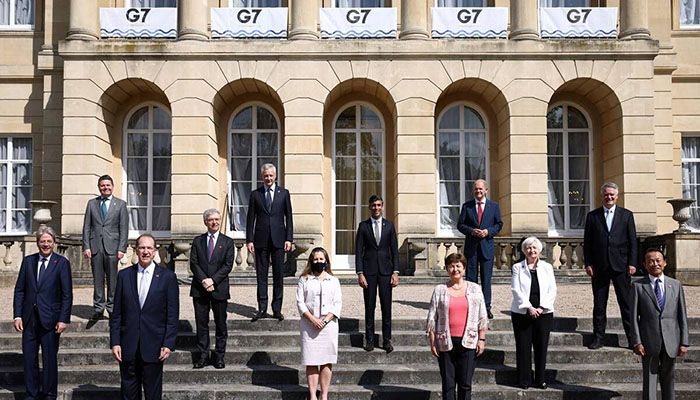

G7: Finance ministers meeting in London also agreed in principle to a global minimum corporate tax rate of 15% to avoid countries undercutting each other. || Photo: Collected

The G7 group of advanced economies has reached a "historic" deal on taxing multinational companies.

Finance ministers meeting in London agreed to battle tax avoidance through measures to make companies pay in the countries where they do business.

They also agreed in principle to a global minimum corporate tax rate of 15% to avoid countries undercutting each other.

Tech giants such as Amazon and Google could be among the companies affected.

It was reported this week that an Irish subsidiary of Microsoft had paid zero corporation tax on $315bn (£222bn) profit last year because it was resident in Bermuda for tax purposes.

The deal announced on Saturday, between the US, the UK, France, Germany, Canada, Italy and Japan, could see billions of dollars flow to governments to pay off debts incurred during the Covid crisis.

Negotiated over many years, it will put pressure on other countries to follow suit, including at a meeting of the G20 next month.

UK Chancellor of the Exchequer Rishi Sunak said the agreement was designed to create a level playing field for global companies.

"After years of discussion, G7 finance ministers have reached a historic agreement to reform the global tax system to make it fit for the global digital age," he said.

Why did they want to change the rules?

Governments have long grappled with the challenge of taxing global companies operating across many countries.

That challenge has grown with the boom in huge tech corporations like Amazon and Facebook.

At the moment companies can set up local branches in countries that have relatively low corporate tax rates and declare profits there.

That means they only pay the local rate of tax, even if the profits mainly come from sales made elsewhere. This is legal and commonly done.

The deal aims to stop this from happening in two ways.

Firstly, the G7 want a global minimum tax rate so as to avoid a "race to the bottom" where countries can undercut each other with low tax rates.

Secondly, the rules will aim to make companies pay tax in the countries where they are selling their products or services, rather than wherever they end up declaring their profits.

What's in the agreement?

The rules on making multinationals pay taxes where they operate - known as "pillar one" of the agreement - would apply to global companies with at least a 10% profit margin.

Twenty percent of any profit above that would be reallocated and taxed in the countries where they operate, according to the G7 communiqué.

In the case of the UK, for example, more tax revenue would be raised from large multinationals and would help pay for public services.

The second "pillar" of the agreement commits states to a global minimum corporate tax rate of 15% to avoid countries undercutting each other.

The agreement will now be discussed in detail at a meeting of G20 financial ministers and central bank governors in July.

Irish Finance Minister Paschal Donohoe, whose country offers a low 12.5% corporate tax rate, tweeted that it was in "everyone's interest to achieve a sustainable, ambitious and equitable agreement on the international tax architecture", but any agreement would have to "meet the needs of small and large countries, developed and developing".

Source: BBC

Subscribe Shampratik Deshkal Youtube Channel

Topic : G7 Multinational companies

© 2024 Shampratik Deshkal All Rights Reserved. Design & Developed By Root Soft Bangladesh